Business

25 richest families in America

Published

2 years agoon

25 richest families in America

Americans are enthralled with watching the lifestyles of the rich and famous unfold on TV and social media. Despite the extravagant cars and vacations showcased on certain programming franchises, the wealth of these celebrities pales in comparison to some of America’s richest families.

To find out which clans hold the most wealth, Stacker compiled a list of the 25 richest families in America using 2020 data from Forbes. Families are ranked in ascending order by their total wealth, with the richest family taking the #1 spot on this list. When ties occur, the families are ranked from the most to the fewest family members.

The gap in net worth between the #25 and the #1 richest family is surprisingly wide, with the wealthiest family in America now worth more than $234 billion. When added together, the 25 families on this list have a combined net worth of $943.7 billion. If these families were a country, they’d be the 17th richest nation in the world as these families are wealthier than Iran, Netherlands, Switzerland, and Turkey when ranked by gross domestic product.

Most of America’s richest families charted their paths to massive wealth in the late 1800s and early 1900s. Some struck it rich by discovering oil in the American South or founding a local business, while others made risky but smart investments. The ancestors of America’s wealthy families were also able to turn failing businesses, like breweries and newspapers, into global enterprises.

While some clans have kept low profiles for over a century, others have gained national attention and name recognition for inheritance battles, affairs, political scandals, and illegal practices. From the world’s largest alcohol manufacturers to grocers, investors, and oil barons, check out the 25 richest families in America.

You may also like: Best value big colleges in America

![]()

Kevin Winter/Getty Images for LAPA

#25. Gallo family

– Net worth: $12.4 billion

– Number of family members: 17 (est.)

– Source of wealth: Wine and liquor

– Headquarters: Modesto, CA

The Gallo family owns several wineries throughout California, New York, and Washington state and more than 23,000 acres of vineyards. In the ’90s, the family purchased large amounts of land in Sonoma, California, and partnered with producers from Italy and France to establish leading brands.

Mark Winfrey // Shutterstock

#24. Rollins family

– Net worth: $13.1 billion

– Number of family members: 11

– Source of wealth: Orkin pest control

– Headquarters: Atlanta, GA

Starting a pest control company doesn’t exactly exude images of a glamorous life, but it’s what established the Rollins family’s billionaire status. Orkin pest control was founded in 1901 and has over 400 locations worldwide.

You may also like: States where food stamps are used the most

Slaven Vlasic // Getty Images

#23. Goldman family

– Net worth: $13.2 billion

– Number of family members: 20

– Source of wealth: Real estate

– Headquarters: New York City area, NY

The Goldman family owns hundreds of high-priced real estate across New York City. Founder Sol Goldman’s company is now owned by his four children and run by his daughter Jane.

Bennett Raglin // Getty Images for GLSEN

#22. Stryker family

– Net worth: $14 billion

– Number of family members: 3

– Source of wealth: Medical equipment

– Headquarters: Kalamazoo, MI

The Stryker family built their multibillionaire fortune from Stryker Corp., a medical equipment company founded by Homer Stryker in 1941. Homer was an orthopedic surgeon who invented several medical devices such as the groundbreaking Wedge Turning Frame, used for patients with challenged mobility during extended hospital stays. This invention helped medical professionals turn and examine patients to prevent complications.

Ronda Stryker, Homer’s granddaughter, has 6% ownership and currently serves as the company’s director.

You may also like: States where food stamps are used the most

Paras Griffin // Getty Images

#21. Cathy family

– Net worth: $14.2 billion

– Number of family members: 35

– Source of wealth: Chick-fil-A

– Headquarters: Atlanta, GA

The Cathys know how to produce fried chicken sandwiches and have built a family fortune with their Chick-fil-A empire. Samuel Truett Cathy, a businessman, investor, and Southern Baptist, founded the family business in Hapeville, Georgia, in 1946.

Many of Cathy’s business decisions stemmed from his Christian beliefs, including his “closed-on-Sundays” policy, which traditionally observes Sundays as a day of rest in Christianity. Many would think being closed on Sundays would financially affect the popular fast-food chain, but the Cathys are still in the billionaires club.

Ilya S. Savenok // Getty Images

#19. Ziff family

– Net worth: $15 billion

– Number of family members: 3

– Source of wealth: Publishing

– Headquarters: New York, NY

The Ziff family originally gained its wealth through a publishing company known for PC Magazine and Car and Driver but later became known for its multibillion-dollar hedge funds. However, in 2014, the three Ziff brothers closed their hedge funds to take a different approach to wealth management.

Justin Sullivan // Getty Images

#19. Dorrance family

– Net worth: $15 billion

– Number of family members: 11 (est.)

– Source of wealth: Campbell Soup Co.

– Headquarters: Camden, NJ

Dorrance family members are the heirs to Campbell Soup Co. John T. Dorrance invented the company’s condensed soup in 1897 and became president of the company 17 years later. Today, Dorrance’s descendants own 41% of the company.

Bettman // Getty Images

#18. Hunt family

– Net worth: $15.5 billion

– Number of family members: 24

– Source of wealth: Oil

– Headquarters: Dallas, TX

H.L. Hunt started his family’s fortune when he struck oil throughout the American South. Hunt, who later based his company, Hunt Oil Co., in Dallas, was named one of the wealthiest men in the country by Time magazine in 2008.

Michael Vi // Shutterstock

#17. Du Pont family

– Net worth: $16 billion

– Number of family members: 3,500 (est.)

– Source of wealth: DuPont

– Headquarters: Wilmington, DE

DuPont originally started as a gunpowder mill during the American Revolution but has grown into one of the largest chemical corporations in the world. According to Forbes, the du Pont family no longer runs the company but still owns shares of the business.

Jacob Hilsdorf/ullstein bild via Getty Images

#16. Busch family

– Net worth: $17.6 billion

– Number of family members: 30 (est.)

– Source of wealth: Anheuser-Busch

– Headquarters: St. Louis, MO

The Busch family legacy began when Adolphus Busch took over a St. Louis brewery in the late 1800s. That same brewery later became Anheuser-Busch, one of the largest breweries in the world. Despite its wild success, the family sold the company in 2008.

JHVEPhoto // Shutterstock

#15. Butt family

– Net worth: $17.8 billion

– Number of family members: 18

– Source of wealth: Supermarkets

– Headquarters: San Antonio, TX

Florence Butt founded the C.C. Butt Grocery Store, now called H-E-B Grocery, in 1905. The family-controlled company has since expanded with hundreds of stores across Texas and Mexico.

F. Carter Smith/Sygma via Getty Images

#14. Marshall family

– Net worth: $18.5 billion

– Number of family members: 3 (est.)

– Source of wealth: Diversified

– Headquarters: Dallas, TX

In the 1960s, J. Howard Marshall II traded his oil company shares for a 15% stake in Koch Industries. Since then, fights over the family’s wealth have made national headlines.

Igor Golovniov/SOPA Images/LightRocket via Getty Images

#13. Brown family

– Net worth: $20.4 billion

– Number of family members: 25 (est.)

– Source of wealth: Liquor

– Headquarters: Louisville, KY

George Garvin Brown founded Brown-Forman Corp. in 1870. Today, the company produces some of the most well-known alcohol brands in the world, including Jack Daniel’s and Korbel.

Michael Macor/The San Francisco Chronicle via Getty Images

#12. Hearst family

– Net worth: $21 billion

– Number of family members: 67

– Source of wealth: Hearst Corp.

– Headquarters: New York, NY

The Hearst family originally gained wealth and notoriety for its mining businesses in the 1880s. However, William Randolph Hearst Jr. made a name for himself by creating the first nationwide media company. Today, Hearst Corp. owns hundreds of newspapers and magazines around the world and has investments in cable TV channels such as ESPN, Lifetime, and A&E.

Bob Levey // Getty Images for U.S. Fund for UNICEF

#11. Duncan family

– Net worth: $22 billion

– Number of family members: 4

– Source of wealth: Pipelines

– Headquarters: Houston, TX

The son of an oil worker, Dan Duncan founded Enterprise Products Partners in 1968. He later became one of the largest pipeline operators in the United States. Today, his eldest daughter, Randa Duncan Williams, chairs the Enterprise Products Partners board.

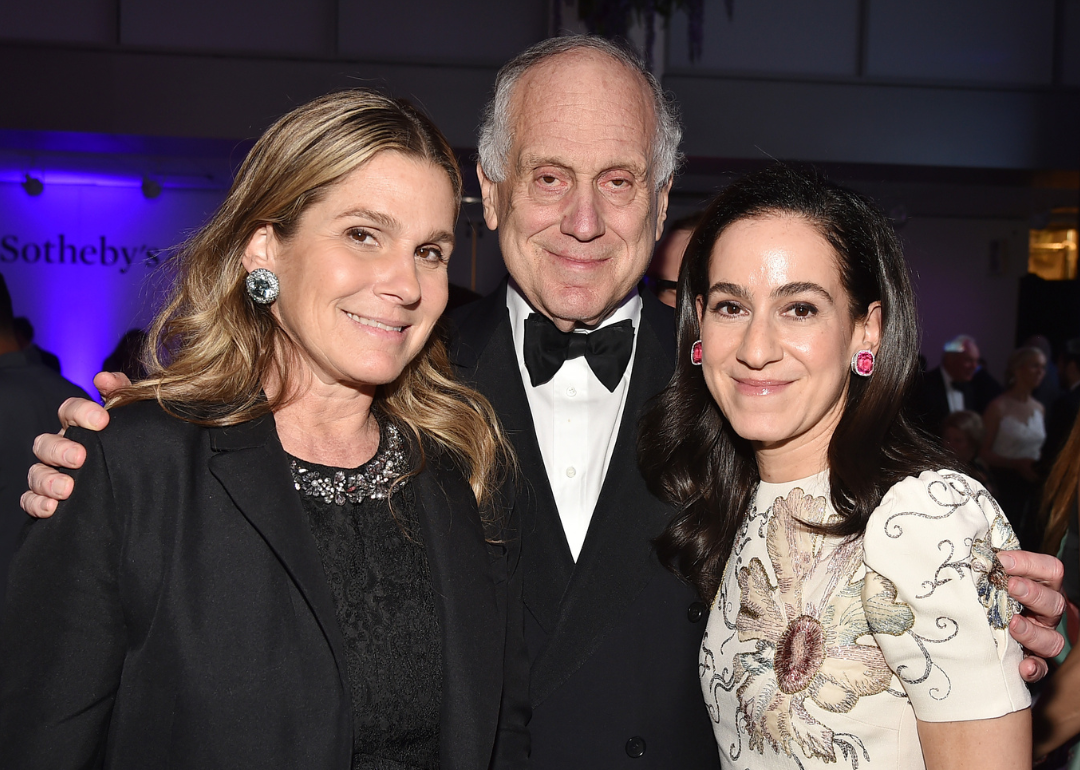

PATRICK MCMULLAN/Patrick McMullan via Getty Images

#10. Newhouse family

– Net worth: $30 billion

– Number of family members: 23

– Source of wealth: Magazines and newspapers

– Headquarters: New York, NY

Samuel Irving Newhouse began what is now an international multimedia publisher with the purchase of the Staten Island Advance in 1922, creating Advance Publications Inc. Now led by S.I. and Donald Newhouse, Advance’s holdings include Condé Nast, Stage Entertainment, American City Business Journals, and Reddit, among others.

Paul Morigi // Getty Images

#9. Pritzker family

– Net worth: $32.5 billion

– Number of family members: 13

– Source of wealth: Hotels and investments

– Headquarters: Chicago, IL

Abram Nicholas Pritzker was the son of Ukrainian immigrants who settled in Chicago in the 1880s. He grew his wealth by purchasing real estate and businesses in the area, and today, the Pritzker family is known for building the Hyatt Hotel chain, among other enterprises.

Library of Congress // Wikimedia Commons

#8. Cox family

– Net worth: $34.5 billion

– Number of family members: 31

– Source of wealth: Media

– Headquarters: Atlanta, GA

The Cox family started amassing its $41 billion fortune in 1898 after James M. Cox purchased the Daytona Evening News. Today, Cox Enterprises includes telecommunications companies Cox Communications and Cox Media Group.

Barry Chin/The Boston Globe via Getty Images

#7. Edward Johnson family

– Net worth: $36 billion

– Number of family members: 6

– Source of wealth: Money management

– Headquarters: Boston, MA

In 1946, Edward C. Johnson II founded the Fidelity Management & Research Company. Today, the privately owned company is managed by his granddaughter, Abigail.

Theo Wargo // Getty Images

#6. S.C. Johnson family

– Net worth: $37 billion

– Number of family members: 68

– Source of wealth: Cleaning products

– Headquarters: Racine, WI

Samuel Curtis Johnson is the founder and namesake of the family-owned SC Johnson company. In the 1800s, Johnson’s parquet flooring business grew after he invented the company’s floor wax. Today, the family is worth $30 billion and owns brands like Glade and Ziploc.

Patrick McMullan/Patrick McMullan via Getty Images

#5. Lauder family

– Net worth: $40 billion

– Number of family members: 10

– Source of wealth: Estée Lauder

– Headquarters: New York, NY

Lauder family members are cosmetics tycoons known for the Estée Lauder brand. The family’s matriarch founded the company with her husband in 1946, and today, the third generation of Lauders—William, Ronald, Aerin, and Jane—help guide the company’s growth and leadership.

Jemal Countess // Getty Images for Stringer

#4. Cargill-MacMillan family

– Net worth: $47 billion

– Number of family members: 23 (est.)

– Source of wealth: Cargill Inc.

– Headquarters: Minneapolis, MN

According to Forbes, the Cargill-MacMillan family has 14 billionaires, the most of any family in the world. Cargill Inc. is worth nearly $115 billion and produces and distributes food items, including sugar, turkey, and chocolate.

Pool // Getty Images

#3. Mars family

– Net worth: $94 billion

– Number of family members: 31

– Source of wealth: Candy

– Headquarters: McLean, VA

The Mars family owns Mars Inc., which produces Snickers, M&M’s, Twix, and other popular candy bars. Despite keeping a low profile for over 100 years, the Mars family is speaking out about climate change and labor practices.

Nikki Kahn/The Washington Post via Getty Images

#2. Koch family

– Net worth: $100 billion

– Number of family members: 4

– Source of wealth: Diversified

– Headquarters: Wichita, KS

The Koch family is worth more than the first seven families on this list combined. The Koch family owns Koch Industries, one of the largest privately owned companies in the United States. Brothers David and Charles also are widely known for their impact on American politics. David died in August 2019.

Rick T. Wilking // Getty Images

#1. Walton family

– Net worth: $247 billion

– Number of family members: 7

– Source of wealth: Walmart

– Headquarters: Bentonville, AR

The Walton family’s wealth began when Sam Walton established the first Walmart in 1962. Today, Walmart is the largest retailer in the world with over 12,000 stores.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

You may like

Business

5 tech advancements sports venues have added since your last event

Published

24 hours agoon

April 19, 2024

In today’s digital climate, consuming sports has never been easier. Thanks to a plethora of streaming sites, alternative broadcasts, and advancements to home entertainment systems, the average fan has myriad options to watch and learn about their favorite teams at the touch of a button—all without ever having to leave the couch.

As a result, more and more sports venues have committed to improving and modernizing their facilities and fan experiences to compete with at-home audiences. Consider using mobile ticketing and parking passes, self-service kiosks for entry and ordering food, enhanced video boards, and jumbotrons that supply data analytics and high-definition replays. These innovations and upgrades are meant to draw more revenue and attract various sponsored partners. They also deliver unique and convenient in-person experiences that rival and outmatch traditional ways of enjoying games.

In Los Angeles, the Rams and Chargers’ SoFi Stadium has become the gold standard for football venues. It’s an architectural wonder with closer views, enhanced hospitality, and a translucent roof that cools the stadium’s internal temperature.

The Texas Rangers’ ballpark, Globe Life Field, added field-level suites and lounges that resemble the look and feel of a sports bar. Meanwhile, the Los Angeles Clippers are building a new arena (in addition to retail space, team offices, and an outdoor public plaza) that will seat 18,000 people and feature a fan section called The Wall, which will regulate attire and rooting interest.

It’s no longer acceptable to operate with old-school facilities and technology. Just look at Commanders Field (formerly FedExField), home of the Washington Commanders, which has faced criticism for its faulty barriers, leaking ceilings, poor food options, and long lines. Understandably, the team has been attempting to find a new location to build a state-of-the-art stadium and keep up with the demand for high-end amenities.

As more organizations audit their stadiums and arenas and keep up with technological innovations, Uniqode compiled a list of the latest tech advancements to coax—and keep—fans inside venues.

![]()

Jeff Gritchen/MediaNews Group/Orange County Register // Getty Images

Just Walk Out technology

After successfully installing its first cashierless grocery store in 2020, Amazon has continued to put its tracking technology into practice.

In 2023, the Seahawks incorporated Just Walk Out technology at various merchandise stores throughout Lumen Field, allowing fans to purchase items with a swipe and scan of their palms.

The radio-frequency identification system, which involves overhead cameras and computer vision, is a substitute for cashiers and eliminates long lines.

RFID is now found in a handful of stadiums and arenas nationwide. These stores have already curbed checkout wait times, eliminated theft, and freed up workers to assist shoppers, according to Jon Jenkins, vice president of Just Walk Out tech.

Billie Weiss/Boston Red Sox // Getty Images

Self-serve kiosks

In the same vein as Amazon’s self-scanning technology, self-serve kiosks have become a more integrated part of professional stadiums and arenas over the last few years. Some of these function as top-tier vending machines with canned beers and nonalcoholic drinks, shuffling lines quicker with virtual bartenders capable of spinning cocktails and mixed drinks.

The kiosks extend past beverages, as many college and professional venues have started using them to scan printed and digital tickets for more efficient entrance. It’s an effort to cut down lines and limit the more tedious aspects of in-person attendance, and it’s led various competing kiosk brands to provide their specific conveniences.

Kyle Rivas // Getty Images

Mobile ordering

Is there anything worse than navigating the concourse for food and alcohol and subsequently missing a go-ahead home run, clutch double play, or diving catch?

Within the last few years, more stadiums have eliminated those worries thanks to contactless mobile ordering. Fans can select food and drink items online on their phones to be delivered right to their seats. Nearly half of consumers said mobile app ordering would influence them to make more restaurant purchases, according to a 2020 study at PYMNTS. Another study showed a 22% increase in order size.

Many venues, including Yankee Stadium, have taken notice and now offer personalized deliveries in certain sections and established mobile order pick-up zones throughout the ballpark.

Darrian Traynor // Getty Images

QR codes at seats

Need to remember a player’s name? Want to look up an opponent’s statistics at halftime? The team at Digital Seat Media has you covered.

Thus far, the company has added seat tags to more than 50 venues—including two NFL stadiums—with QR codes to promote more engagement with the product on the field. After scanning the code, fans can access augmented reality features, look up rosters and scores, participate in sponsorship integrations, and answer fan polls on the mobile platform.

Boris Streubel/Getty Images for DFL // Getty Images

Real-time data analytics and generative AI

As more venues look to reinvigorate the in-stadium experience, some have started using generative artificial intelligence and real-time data analytics. Though not used widely yet, generative AI tools can create new content—text, imagery, or music—in conjunction with the game, providing updates, instant replays, and location-based dining suggestions

Last year, the Masters golf tournament even began including AI score projections in its mobile app. Real-time data is streamlining various stadium pitfalls, allowing operation managers to monitor staffing issues at busy food spots, adjust parking flows, and alert custodians to dirty or damaged bathrooms. The data also helps with security measures. Open up an app at a venue like the Honda Center in Anaheim, California, and report safety issues or belligerent fans to help better target disruptions and preserve an enjoyable experience.

Story editing by Nicole Caldwell. Copy editing by Paris Close. Photo selection by Lacy Kerrick.

This story originally appeared on Uniqode and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Business

Import costs in these industries are keeping prices high

Published

1 week agoon

April 11, 2024

Inflation has cooled substantially, but Americans are still feeling the strain of sky-high prices. Consumers have to spend more on the same products, from the grocery store to the gas pump, than ever before.

Increased import costs are part of the problem. The U.S. is the largest goods importer in the world, bringing in $3.2 trillion in 2022. Import costs rose dramatically in 2021 and 2022 due to shipping constraints, world events, and other supply chain interruptions and cost pressures. At the June 2022 peak, import costs for all commodities were up 18.6% compared to January 2020.

While import costs have since fallen most months—helping to lower inflation—they remain nearly 12% above what they were in 2020. And beginning in 2024, import costs began to rise again, with January seeing the highest one-month increase since March 2022.

Machinery Partner used Bureau of Labor Statistics data to identify the soaring import costs that have translated to higher costs for Americans. Imports in a few industries have had an outsized impact, helping drive some of the overall spikes. Crop production, primary metal manufacturing, petroleum and coal product manufacturing, and oil and gas extraction were the worst offenders, with costs for each industry remaining at least 20% above 2020.

![]()

Machinery Partner

Imports related to crops, oil, and metals are keeping costs up

At the mid-2022 peak, import costs related to oil, gas, petroleum, and coal products had the highest increases, doubling their pre-pandemic costs. Oil prices went up globally as leaders anticipated supply disruptions from the conflict in Ukraine. The U.S. and other allied countries put limits on Russian revenues from oil sales through a price cap of oil, gas, and coal from the country, which was enacted in 2022.

This activity around the world’s second-largest oil producer pushed prices up throughout the market and intensified fluctuations in crude oil prices. Previously, the U.S. had imported hundreds of thousands of oil barrels from Russia per day, making the country a leading source of U.S. oil. In turn, the ban affected costs in the U.S. beyond what occurred in the global economy.

Americans felt this at the pump—with gasoline prices surging 60% for consumers year-over-year in June 2022 and remaining elevated to this day—but also throughout the economy, as the entire supply chain has dealt with higher gas, oil, and coal prices.

Some of the pressure from petroleum and oil has shifted to new industries: crop production and primary metal manufacturing. In each of these sectors, import costs in January were up about 40% from 2020.

Primary metal manufacturing experienced record import price growth in 2021, which continued into early 2022. The subsequent monthly and yearly drops have not been substantial enough to bring costs down to pre-COVID levels. Bureau of Labor Statistics reporting shows that increasing alumina and aluminum production prices had the most significant influence on primary metal import prices. Aluminum is widely used in consumer products, from cars and parts to canned beverages, which in turn inflated rapidly.

Aluminum was in short supply in early 2022 after high energy costs—i.e., gas—led to production cuts in Europe, driving aluminum prices to a 13-year high. The U.S. also imposes tariffs on aluminum imports, which were implemented in 2018 to cut down on overcapacity and promote U.S. aluminum production. Suppliers, including Canada, Mexico, and European Union countries, have exemptions, but the tax still adds cost to imports.

U.S. agricultural imports have expanded in recent decades, with most products coming from Canada, Mexico, the EU, and South America. Common agricultural imports include fruits and vegetables—especially those that are tropical or out-of-season—as well as nuts, coffee, spices, and beverages. Turmoil with Russia was again a large contributor to cost increases in agricultural trade, alongside extreme weather events and disruptions in the supply chain. Americans felt these price hikes directly at the grocery store.

The U.S. imports significantly more than it exports, and added costs to those imports are felt far beyond its ports. If import prices continue to rise, overall inflation would likely follow, pushing already high prices even further for American consumers.

Story editing by Shannon Luders-Manuel. Copy editing by Kristen Wegrzyn.

This story originally appeared on Machinery Partner and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Business

The states where people pay the most in car insurance premiums

Published

2 weeks agoon

April 4, 2024

Nearly every state requires drivers to carry car insurance, but the laws vary, and many factors affect the cost of coverage.

Some are controllable, at least to degrees: the type of car you have and your credit history. Some are not: your age and gender. Your marital status, place of residence, and claims history are among the other variables that go into it.

Across the United States, premiums are soaring, rising 20% year over year and increasing six times faster than consumer prices overall as of December 2023, CBS reported. Last September, CNN noted that car insurance rates jumped more in the previous year than they had since 1976.

CBS pointed to many potential reasons for these increases in prices. Coronavirus pandemic-era issues have made buying, fixing, and replacing vehicles costlier. Extreme weather events caused by climate change also damage more vehicles, while insurance companies are increasing their business costs. Severe and more frequent crashes are to blame as well, CNN reported.

On top of these, local factors such as population density, the number of uninsured drivers, and the frequency of insurance claims all affect premiums, which can lead motorists to change or switch their coverage, use other modes of transportation, or even alter decisions about when to buy a vehicle or what to look for.

To see how geography affects cost, Cheap Insurance mapped the states where people pay the most in car insurance premiums using MarketWatch data. Premium estimates were based on full-coverage car insurance for a 35-year-old driver with good credit and a clean driving record. Data accurate as of February 2024.

![]()

Cheap Insurance

Americans pay $167 per month on average for full-coverage insurance

There are common denominators among the five states where it’s most expensive to have car insurance: Michigan, Florida, Louisiana, Nevada, and Kentucky. Washington D.C. is another pricey locale, ranking #4 overall.

Three of these six are no-fault jurisdictions and require additional coverage beyond coverage to pay for medical costs. Michigan notably calls for $250,000 in personal injury protection (though people with Medicaid and Medicare may qualify for lower limits), $1 million in personal property insurance for damage done by your car in Michigan, and residual bodily injury and property damage liability that starts at $250,000 for a person harmed in an accident.

Other commonalities between these states include high urban population densities. At least 9 in 10 people in Nevada, Florida, and Washington D.C. live in cities and urban areas, which leads to more crashes and thefts and high rates of uninsured drivers and lawsuits. Additionally, Louisiana, Florida, and Kentucky rank #5, #8, and #10, respectively, in motor vehicle crash deaths per 100 million vehicle miles traveled in 2021 based on Department of Transportation data analyzed by the Insurance Institute for Highway Safety.

Canva

#5. Kentucky

– Monthly full-coverage insurance: $210

– Monthly liability insurance: $57

Canva

#4. Nevada

– Monthly full-coverage insurance: $232

– Monthly liability insurance: $107

Canva

#3. Louisiana

– Monthly full-coverage insurance: $253

– Monthly liability insurance: $77

Canva

#2. Florida

– Monthly full-coverage insurance: $270

– Monthly liability insurance: $115

Canva

#1. Michigan

– Monthly full-coverage insurance: $304

– Monthly liability insurance: $113

Story editing by Carren Jao. Copy editing by Paris Close. Photo selection by Lacy Kerrick.

This story originally appeared on Cheap Insurance and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Featured

-

Business4 months ago

Business4 months agomesh conference goes deep on AI, with experts focusing in on training, ethics, and risk

-

Business4 months ago

Business4 months agoSkill-based hiring is the answer to labour shortages, BCG report finds

-

Events6 months ago

Events6 months agoTop 5 tech and digital transformation events to wrap up 2023

-

People4 months ago

People4 months agoHow connected technologies trim rework and boost worker safety in hands-on industries

-

Events3 months ago

Events3 months agoThe Northern Lights Technology & Innovation Forum comes to Calgary next month